The rate of RA is 60 on the qualifying capital expenditure ie. While annual allowance is a flat rate given every year.

This Is Malaysia Tax Question It Is A Very Long Chegg Com

Malaysia has a wide variety of incentives covering the major industry sectors.

. Federal Government Gazette Income Tax Accelerated Capital Allowance Automation Equipment Rules. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. The Income Tax Accelerated Capital Allowance Automation Equipment Rules 2017 the Principal Rules which allows a qualifying company to claim accelerated capital.

1 January 2015 to 31 December 2020. Malaysian Taxation Capital Allowances Charges Page. Corporate - Tax credits and incentives.

Standard rates With effect from YA 2000 cyb capital allowances are re-categorised into three classes and the rates of capital allowances are revised as follows. Objective The objective of this Public Ruling PR is to explain. 03-21731288 Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M.

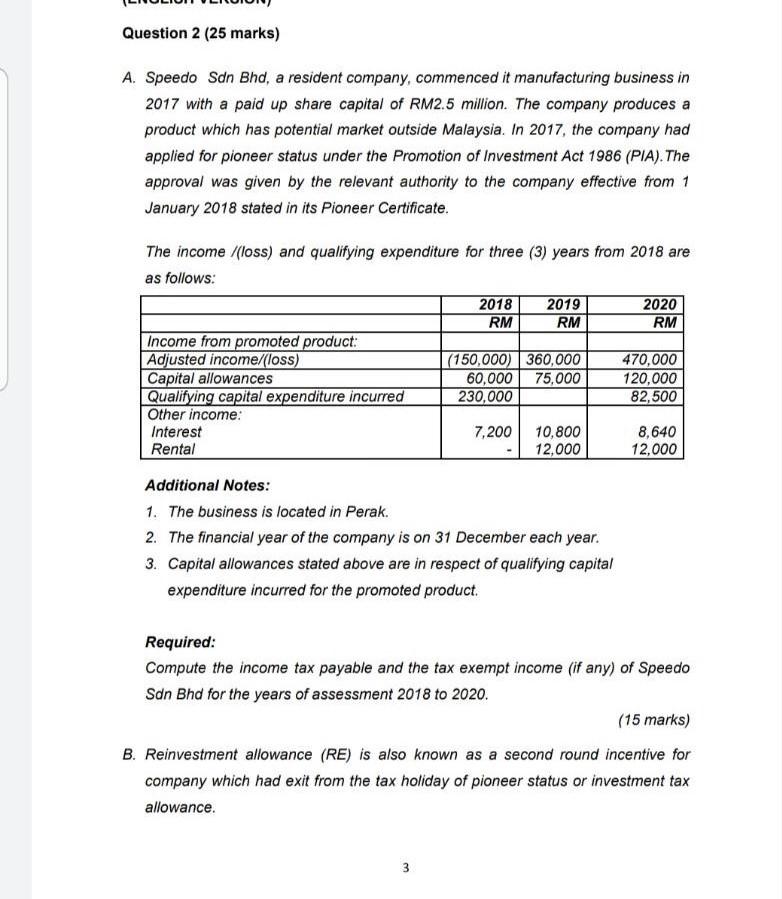

YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business. Last reviewed - 14 December 2021. Fundamentals Level Skills Module Paper F6 MYS SeptemberDecember 2017 Sample Answers Taxation Malaysia and Marking Scheme Section B Marks 1 aDelia Spa Sdn Bhd.

72018 Date Of Publication. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. On 30 August 2017 two orders PUA 2522017 and PU A 2532017 that are effective as from year of assessment 2015 were published in Malaysias federal gazette to.

Income Tax Accelerated Capital Allowance Automation Equipment Rules 2017. In March 2017 Malaysia joined the Inclusive Framework on BEPS as a BEPS Associate and is committed to the implementation of 4 minimum standards ie. INLAND REVENUE BOARD OF MALAYSIA COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No.

8 June 2017 Page 1 of 24 1. Qualifying Expenditure For Purposes Of Claiming Allowances. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to.

Example 8 amended on 12072017. CLAIMING ALLOWANCES Public Ruling No. In the 2020 Economic Stimulus Package announced on 27 February 2020 it was proposed that.

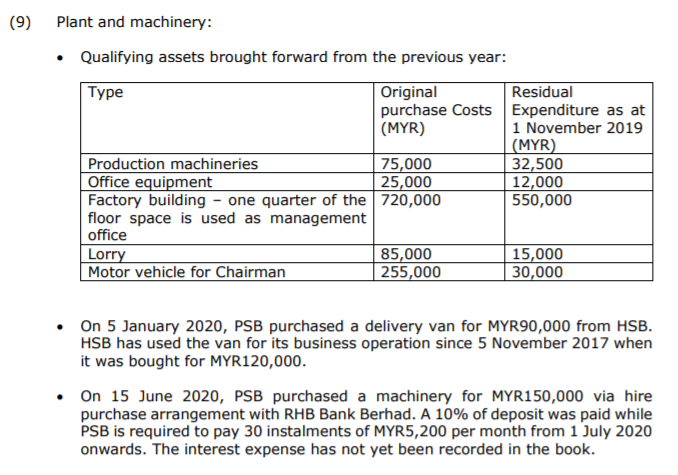

One of these deductions is the capital allowances in Malaysia. Your company purchased a machine for 120000 with cash in the basis. Capital allowance can be claimed from YA 2019 2017 2018 2018 Only cost incurred from YA 2018 is a qualifying expenditure.

Qualifying expenditure QE QE includes. B6 CAPITAL ALLOWANCES A1. 27 August 2015.

Restrictions apply on maximum qualifying capital expenditure. View Tutorial 2 - Capital Allowances - Questionpdf from TAXATION 2 at Methodist Pilley Institute - Malaysia. 1 January 2015 to 31 December 2017.

These proposals will not become. Accelerated capital allowance ACA for the purchase of machinery and equipment. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

Inland Revenue Board of Malaysia. Year of Assessment 2017. The GST treatment on.

Capital allowance can be claimed from YA. The RA is used to reduce up to 70 of statutory. 62015 Date Of Publication.

While the 28 tax rate for non-residents is a 3 increase from the previous years. Accelerated Capital Allowance Automation Equipment 2017. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

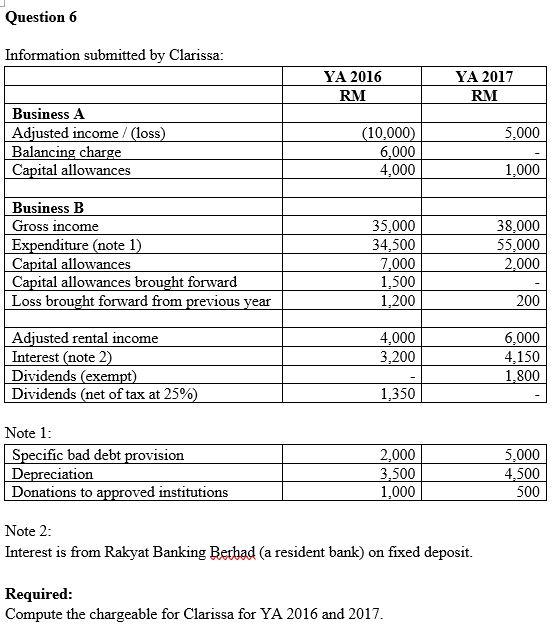

Find out information on capital allowance CA such as who can claim CA as well as how to claim and calculate CA. Business loss for the year of assessment 2016 capital allowances bf and current year capital allowances on other assets were RM160000 RM30000 and RM55000 respectively. Type of Asset Initial Allowance Rate Annual Allowance Rate Heavy machinery and.

Factory plant and machinery and is granted in addition to capital allowances. Accelerated capital allowance is available for certain types of industrial building plant and machinery. 22017 Date of Publication.

Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed.

Solved Question 2 25 Marks A Speedo Sdn Bhd A Resident Chegg Com

Malaysia Airlines Moves From Piece To Weight Concept May 1 2017 Loyaltylobby

5 Capital And Industrial Building Allowances Initial Chegg Com

Personal Income Tax In Asean A Guide To 2017 Rates Asean Business News

Caterpillar Sales Jump 18 In 2017 With 4q Surge Equipment World

Question 5 Amar A Malaysian Resident Has Income From Chegg Com

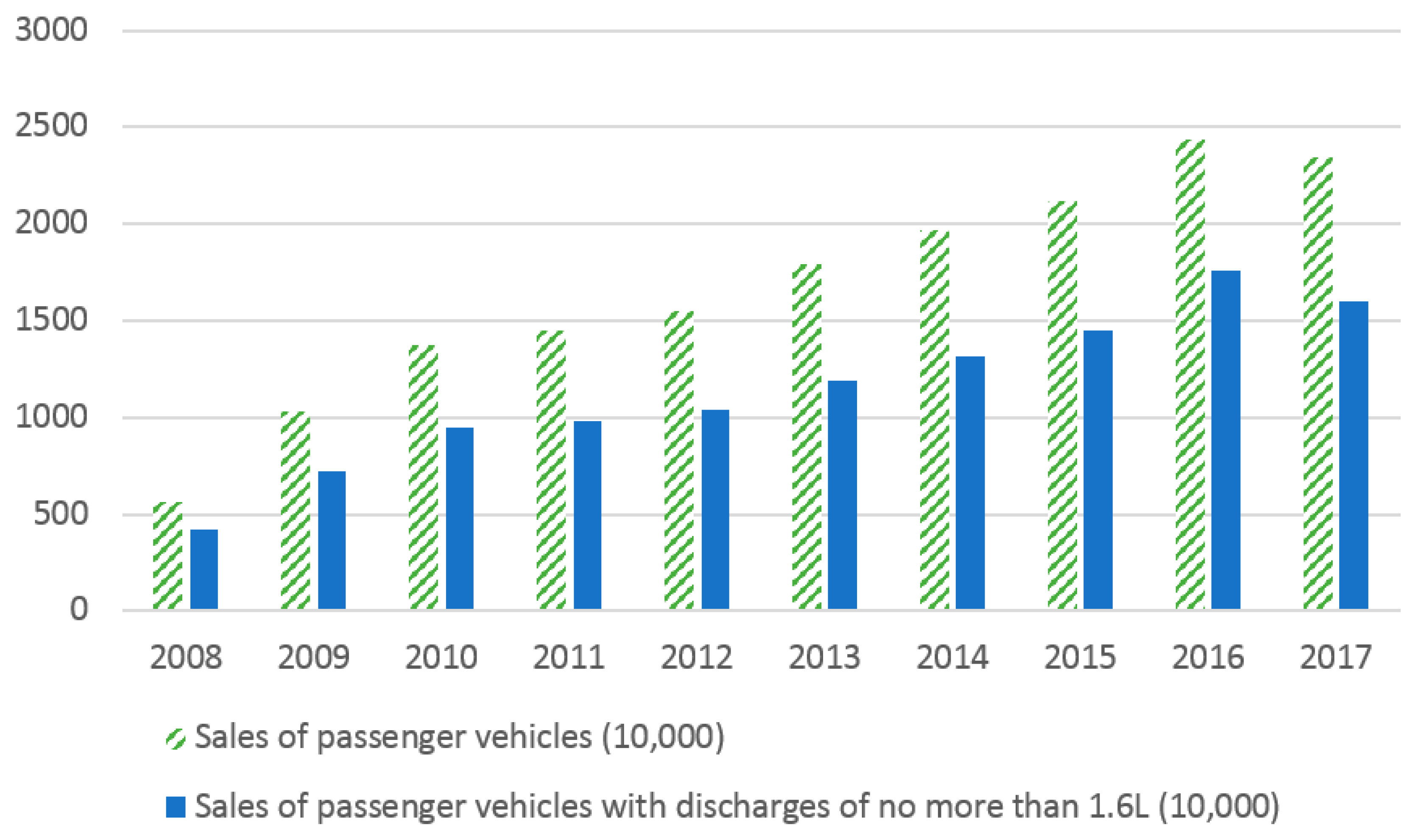

Sustainability Free Full Text On The Use Of Market Based Instruments To Reduce Air Pollution In Asia Html

Budapest Castle Castle Sketch Urban Sketching Architecture Drawing

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

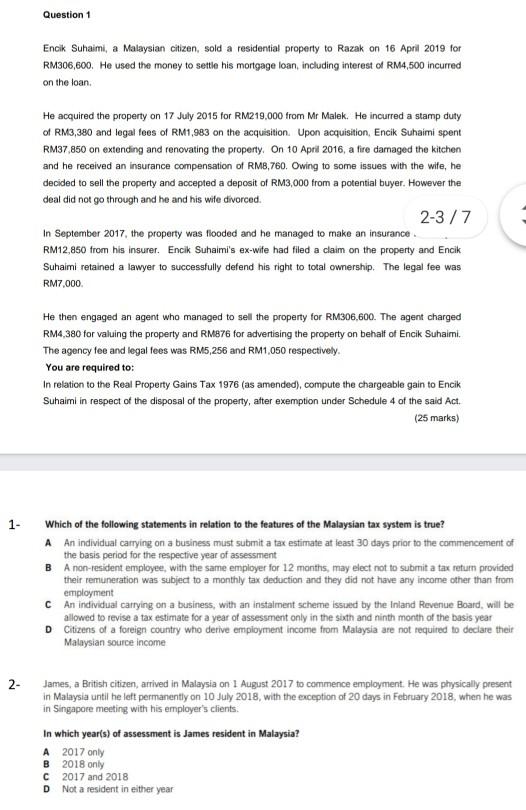

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

An Analysis Of Malaysian Rubber Glove Industry Blogs Televisory

Malaysia Airlines Moves From Piece To Weight Concept May 1 2017 Loyaltylobby

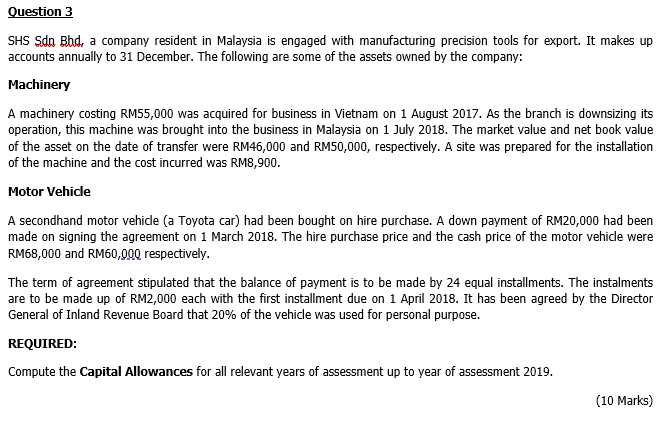

Question 3 Shs Sdn Bhd A Company Resident In Chegg Com

Malaysia Airlines Moves From Piece To Weight Concept May 1 2017 Loyaltylobby

Siniawan Old Town Turns Into A Beautiful Food Street Over The Weekend Which Is One Of The Must Visit Places Out Of Kuching Travel Instagram Sarawak Food Street

Malaysia Market Profile Hktdc Research

Question 3 Shs Sdn Bhd A Company Resident In Chegg Com

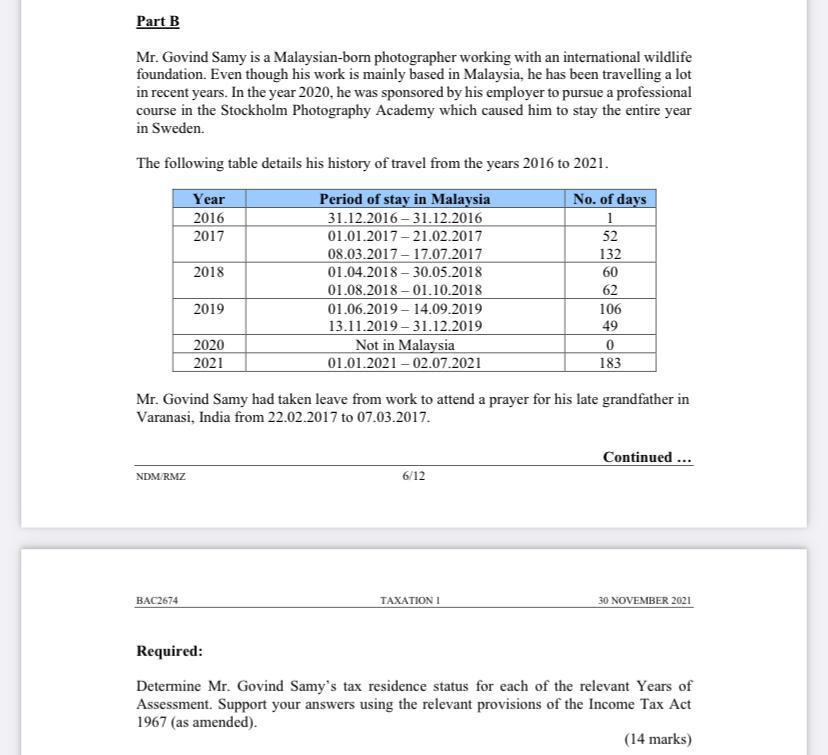

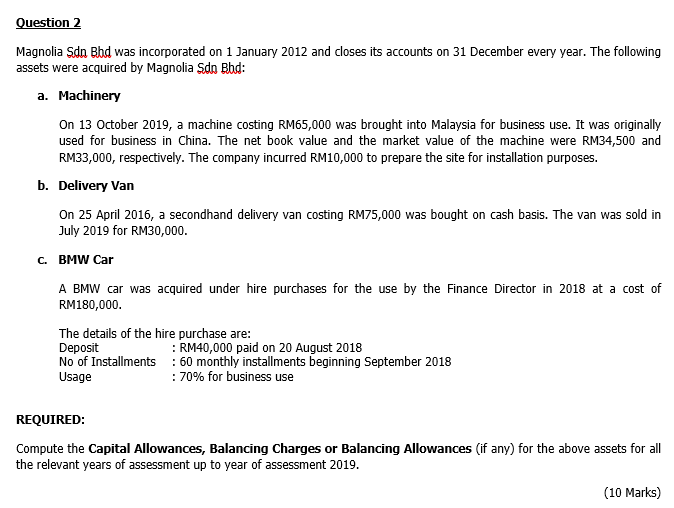

Tax 467 March 2019 Question 1 Mr Noah An American Citizen Was Employed As A Dentist By My Dental Studocu